Small business owners and newbie entrepreneurs often cringe at the thought of a financial audit. Although an audit conducted by the Internal Revenue Service (IRS) can be a highly stressful event, an audit performed by a third-party firm or a professional auditor in your organization is often vital to solid business operations.

Performing financial audit procedures is an effective way to make sure that the financial statements generated by the company are accurate and free from any discrepancies.

When talking about business audits, there’s the regular audit and a forensic audit. At first glance, you might think that the latter is something exciting you hear on crime dramas, such as CSI or Law and Order. The truth, though, is that forensic auditing is a little more mundane — but still important if you are trying to uncover compliance failure or combating fraud.

What is a Forensic Audit?

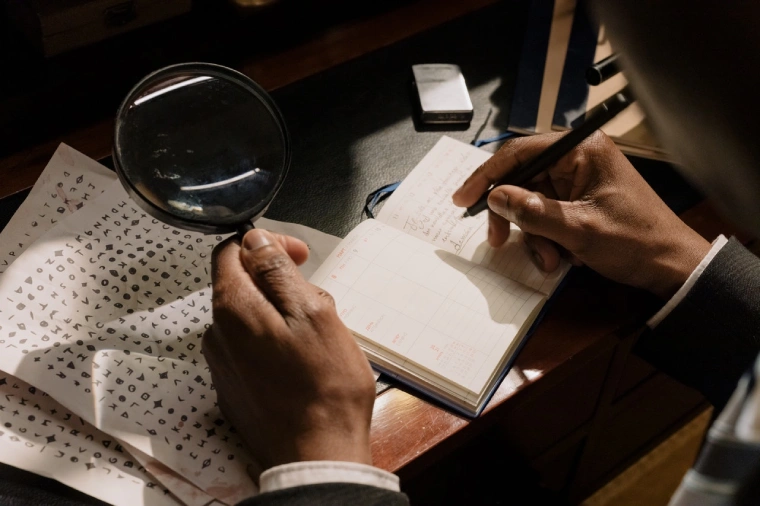

A forensic audit assesses and examines a company’s or even a person’s financial records to derive evidence used in a legal proceeding or a court of law.

Forensic auditing is an accounting specialization, and a lot of big accounting companies have forensic auditors. This type of audit requires auditing and accounting procedures, as well as expert knowledge regarding the legal framework of such an audit.

When is a Forensic Audit Necessary?

A forensic audit may be necessary to dispel accusations of embezzlement or fraud. A certified fraud examiner (CFE) in these two cases will keep an eye out for signs of criminal activities within the financial statements to disprove concerns about illegal activities.

Here are a few situations that may compel a business to do forensic auditing:

Financial Statement Fraud

This includes misinformation or misrepresentation on the public records a firm produces for its shareholders and board of directors. Unfortunately, some companies resort to fraud as a way of improving the appearance of their financial standing. This tactic, though, is illegal.

Companies that need to dispel any belief or suspicion of financial statement fraud should perform a forensic audit. This procedure will encourage trust in shareholders and board members.

A forensic auditor tasked to find this type of fraud may check accounting records and compare the data to records of transactions of expenses or revenue. The goal is to figure out if the financial statements produced by the company account for all relevant financial information.

Misappropriation of Assets

Many fraud schemes uncovered by a forensic audit are those involving asset misappropriation. This illegal activity involves employees or third-party individuals in an organization who abuse their position and power to steal from the company through fraudulent activity.

Some examples of misappropriation of assets include the following:

- Misplacement of cash

- Inventory theft

- Payments to fake employees or vendors

- Improper use of company assets

- Generation of fake invoices

Businesses perform a forensic audit to determine the person (and sometimes even the group) behind these nefarious activities.

A common form of asset misappropriation is embezzlement. This occurs when an employee misplaces or misuses cash for their personal gain at the expense of the company. Stopping this illegal activity goes beyond improving the bottom line of the business. It will also help reinstate the integrity of the workers in the eyes of the organization and the business world.

Corruption

This crime isn’t just something you’ll find in government units. It exists in the private sector, as well.

An organization may address accusations of corruption with forensic auditing to disprove those claims.

Examples of corruption include:

- Extortion – This term refers to the wrongful use of intimidation, violence or force, regardless if it’s actual or threatened, to obtain property or money from an individual or entity. If a company, for instance, violently demands money to award a business contract, then this would amount to extortion.

- Bribery – This refers to the act of offering money or other forms of compensation to influence a situation in one’s favor or get things done. An example of this crime is a company bribing an employee to generate fake data to make their financial statements look positive even if the reality is the opposite.

- Conflict of Interest – This occurs when a fraudster uses their influence or power for personal gains to the detriment of the company. An example is a C-suite executive allowing or approving inaccurate expenses of a worker with whom they have personal relations. Although the executive did not financially benefit from this approval directly, they are likely to receive personal benefits following those inappropriate approvals.

A business can hire a forensic auditor to check for instances of corruption within the company, so that they can update their safeguards and make the necessary managerial changes.

Performing a Forensic Audit

The process of conducting a forensic audit is, in some ways, similar to the process of doing a regular financial audit. The former does, however, have additional considerations.

Here are the steps involved in forensic auditing:

Plan the Investigation

During a forensic audit, the auditor is required to understand the focus of the audit. This professional will conduct an investigation to achieve the following objectives:

- Determine the type of fraud (if any) being carried out

- Collect relevant evidence that is admissible in the court

- Figure out when the illegal activity occurred

- Quantify the financial loss suffered by the organization as a result of the fraud

- Uncover how the perpetrator concealed the fraud

- Name the people behind the criminal activity

- Recommend measures that can help prevent such frauds from happening in the future

Gather Evidence

The forensic auditor will gather evidence for your financial statements. You need to make sure that all financial receipts, statements and records are available to the auditor during the course of their investigation.

Relevant evidence collected during the forensic audit enables the organization to prosecute the people behind the fraudulent activity. Forensic auditors take precautions to make sure no one can change the findings and records, so that your attorneys can admit the gathered evidence into court cases.

Compile a Report

At the end of the process, the forensic auditor will compile a report that details their findings. They will give this report to their client to end their investigation. The report will include a determination of whether fraud was present in their investigation. If someone within the organization committed fraud or other illegal activity, the report will mention this in detail.

A forensic audit is a process you should conduct if you believe that there’s fraud happening in your company. The investigation will likely result in legal proceedings against one or several probable perpetrators. What’s more, it will encourage your organization to improve its business process to prevent similar incidences from happening again.